Humm Finance

How humm works

.With humm, you can spread the cost of purchases up to €30,000 when buying online or in-store from any of our retail partners. This can help you manage your finances and make larger purchases more affordable. Please keep in mind that humm is a form of credit and it’s important to consider your ability to repay the amount borrowed. When you use humm credit, the total amount you will have to pay depends on:

The amount borrowed

The term of the credit agreement

The interest rate

(and any interest free period)

The application fee

Any monthly account keeping fees

Available credit terms, interest rates and fees will vary between retailers. More information about the range of interest rates, fees and charges that apply to our credit agreements is available here.

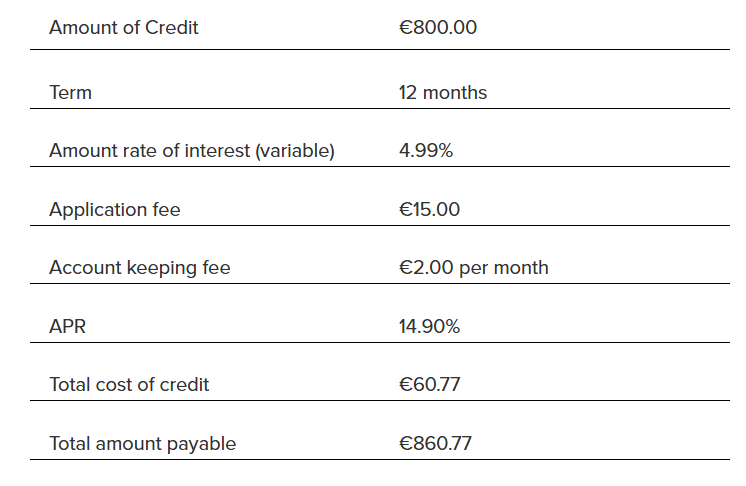

The following example shows the total cost of credit for a loan of €800 over 12 months and is calculated on the assumption that all payments are made on the due date.

You may also have to pay a late fees, if any payment you are required to make under the terms of your agreement is more than 24 hours late.